Opportunities to Be Thankful for In the Current Market

It’s no secret that this ’23 season has posed challenges for market participants across the board. Amidst mass negative sentiments, it is easy to overlook the positives and lose faith in the objective. While current market conditions remain tough, there are still investment opportunities to minimize risk and drive returns. In recent reports, our analysts have shed light on a few bright spots in real estate that may harbor potential returns for interested parties.

Sector Allocation

- The Industrial, Single-Family Rental, and Senior Housing sectors present strong fundamentals, with robust NOI (Net Operating Income) growths that exceed national averages. Note, the Industrial sector remains a top performing sector despite recently facing downward revisions.

- When looking at the private market DCF expected returns, we can determine the sectors that offer the best relative value based on valuations considering yield, cap-ex, growth, and risk. Ground Lease, Gaming, Health Care, and Cold Storage are the most notable sectors, given their high return estimates over the last few months.

- The last sector worth mentioning is Data Centers, the sector in which investor interest is at an all-time high. This is far from surprising, given the sector boasts one of the most favorable growth outlooks of any commercial property type. What’s most enticing is demand handily outpacing supply, giving landlords the upper edge in lease negotiations, helping to lift rental rates for the first time in a decade.

Market Performance

- Fiscal health is a key indicator of market health, as it signals the ability of a local market to sustain government funding without additional tax increases. Of the top 50 U.S. markets, Charlotte, Atlanta, and several Texas cities are amongst the strongest economic performers. Each thriving with the positive impacts that high fiscal health brings, such as population growth, lower tax burdens, etc.

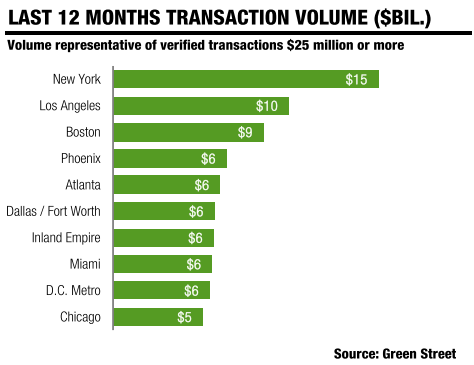

- Markets like New York, Boston, and Los Angeles are leading the pack with the highest transaction volume over the last 12 months. All of which have recent contributions from hotel transactions, which have also been a positive aspect of commercial real estate.

Macro Trends

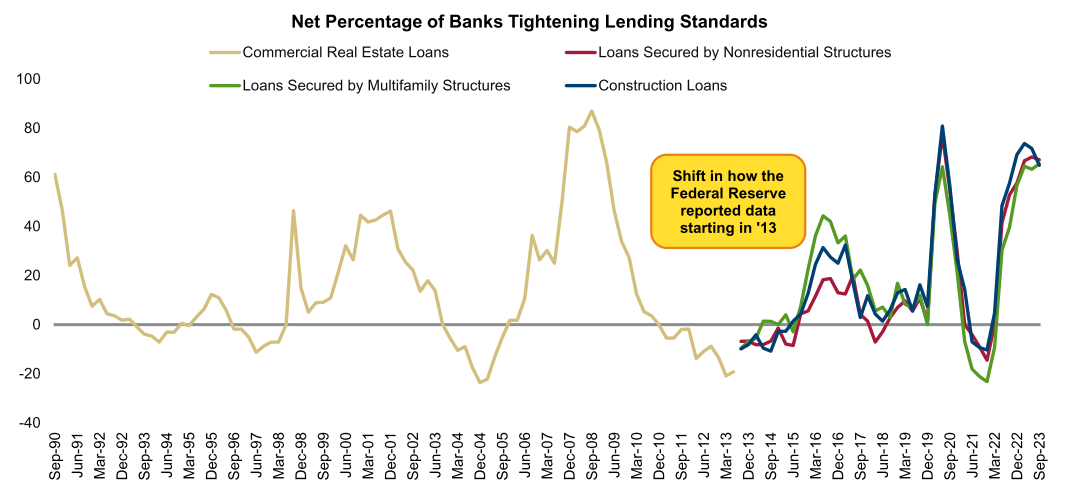

- The Federal Reserve released the updated Senior Loan Officer Opinion Survey on Bank Lending Practices for 3Q23. Notably, banks reported that lending standards for commercial real estate loans remained tight, however, the rate of change of tightening has slowed as fewer banks tightened lending further. Fortunately for borrowers, this could be the peak in lending standards that they’ve been waiting for.

- There are opportunities for investors with the ability to play on both sides of the public/private fence. A rise in real rates has made yields available on real estate debt an attractive option relative to private real estate equity. Further, REITs historically outperform private real estate funds when an investor’s entry point is at large discounts to GAV, as is the case today. Less compelling, but still worthwhile, is the equity pricing of public real estate versus the S&P 500.

“Real estate investors have much to be thankful for if they know where to find a new source of blessings.”

Although it may seem daunting, reworking investment strategies can lead to fruitful endeavors. With forward-looking thought leadership and reliable data, it is possible to mitigate risks and seize opportunities that drive returns through all market environments.

To keep up with Green Street’s differentiated perspective and receive notifications for future posts, opt-in for insights.

Speak with a member of our team today to learn how you can use Green Street’s research and intelligence in your strategy.

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Year in Review

Top React News Articles from 2023

Real Estate Alert

CBRE's Capital-Markets Chief To Step Down

Reports Highlights