Industry-leading commercial real estate intelligence and analytics to make better and faster investment decisions.

Our comprehensive platform, proven track record, exclusive news and 35+ years of trusted insight offers a powerful solution to help market participants maximize every opportunity and drive returns.

Data & Analytics

Proprietary analytics and actionable intelligence for public and private market investors

Research

Unbiased macro, sector, market, and company-level commercial real estate research and analysis

News

Exclusive market-moving news, deal insights, databases and market participant rankings

Advisory Services

Strategic advice for CRE investors and operators to enhance value for stakeholders

Featured Content

Differentiated and unbiased perspective for better decision-making

Product Enhancement

New Private Market Coverage & Outlook Reports

Expanded global Lodging and Data Center coverage brings new proprietary data, analytics, and insights to our private market solution with comprehensive Sector Outlook reports.

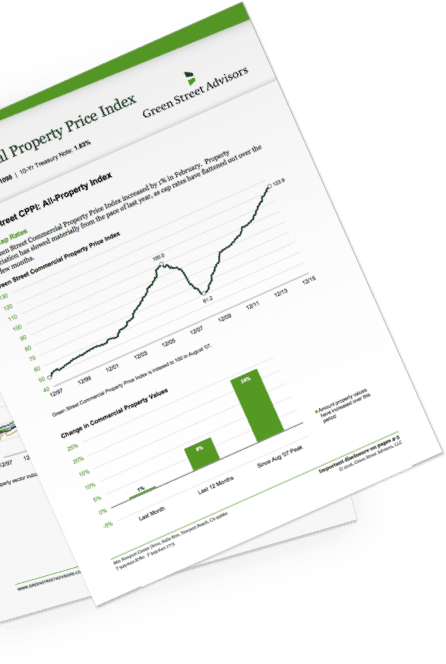

Green Street Data

Commercial Property Fairly Valued

The Green Street Commercial Property Price Index® was unchanged in March.

Webinar

Webinar: Recalibrating and Quantifying the “E” Impact on CRE

Institutional investors are increasingly incorporating “E” factors in underwriting, yet environmental issues in commercial real estate, particularly as they relate to energy and emissions, are complex and opaque. Tune in to learn more.

Webinar

Webinar: Finding Opportunities in a Noisy World

Commercial real estate investors are hoping for normalization in 2024 as property values should stabilize, transaction activity rebound from a shallow 2023 and fundamentals hold their own. But this situation is unlikely to play out evenly across all property types. Tune in to hear our views.

Product Enhancement

NEW: Granular CMBS Loan Collateral Details Available to Download in Excel

Need to quickly access granular views of CMBS loan details? We’ve consolidated the highly sought-after loan data and made it accessible to download in Excel format. Green Street’s CMBS database now includes condensed summaries of public, SEC-registered deal insights for the majority of conduit deals, going back 10 years.

Product Enhancement

Unlock the Power of Historical Data for Informed Investment Decisions!

U.S. Market Data now contains 20+ years of historical market-level data for seven property sectors. With the full time series users can evaluate the potential of seven property sectors across the top 50 MSAs, using past performance insights to support portfolio allocation and risk management strategies.

Research

2024 Sector Outlooks Have Released!

Green Street is excited to unveil the 8 new 2024 U.S. Sector Outlook reports. Gain an in-depth understanding of supply and demand dynamics, risks and opportunities, valuation trends, capital expenditures, and return expectations.

Webinar

2024 Industry Leaders Discussion: A Call with Michael Bluhm

Join us January 30 for a conversation with Michael Bluhm, Global Head of Gaming & Lodging Investment Banking at Morgan Stanley, as he discusses secular trends within the hospitality business, prospects for hotel investment sales activity, and other trends shaping the lodging industry.

Product Enhancement

New Granular Data Enhancements

Green Street has added historical market-level rent growth and occupancy data to its U.S. Market Data product which offers extensive forecasts, time series, macroeconomic scenarios, verified sales comps & more granular data for seven property sectors.

Webinar

Webinar: Challenges Ahead as ’24 Looms

Join Green Street for a 45-minute discussion across Residential, Industrial, Office, Data Center, Self-Storage, and Retail with our Sector Specialists to hear our Research Team’s views on the outlook in each property space on December 7, 2023.

Press Release

Green Street Acquires Local Data Company (LDC)

Green Street’s latest acquisition expands its Pan-European product suite with the addition of extensive granular UK retail and leisure location data.

Product Enhancement

Green Street data is now available on Snowflake!

Green Street has partnered with Snowflake and is engaging with their Data Cloud to deliver data in an easy-to-access format. This new data delivery method helps you to easily extract extensive time series and seamlessly incorporates into your own company models, integrations, and daily workflows.

Product Enhancement

Expanded U.S. Senior Housing Coverage

Green Street expands its private market solution with the addition of Senior Housing data and analytics across the top 50 U.S. markets.

In the News

CNBC Squawk Box Interview: Dangers Lurking in Real Estate?

In this exclusive interview with anchor Becky Quick of CNBC Squawk Box, Green Street’s EVP and Director of Research Cedrik Lachance, provides his outlook on cash-flowing property sectors, the Office sector and the challenges facing some commercial real estate lenders and borrowers as a potential wave of loans is expected to come due over the next three years.

Thought Leadership

Green Street: The Commercial Real Estate Thought Leader

Find out why Green Street’s intelligence, backed by a talented team and thriving culture, can offer a competitive edge for investment decision-making or a rewarding career.

Product Enhancement

What Direction is Private Market Pricing Headed?

Green Street has released its inaugural Commercial Property Monthly report, providing detailed cross-sector valuations for the U.S. private-market, delivered monthly.

Over 450 years of collective experience

Our large, experienced analyst team provides views on the global economy, REITs, individual properties and everything in between. Our analysts specialize by property type and move beyond superficial statistical tools to evaluate properties, markets, and companies with depth.

Hypothetical Track Record

20% Average Annualized Return on Buys

For over 25 years, our Buy recommendations for publicly-traded stocks have outperformed our Sells by an average of 20 percentage points each year. Our team of experienced analysts has a proven track record projecting the direction of commercial property and REIT market values.

- Buy

- Hold

- Sell

- Universe