Property Insights: Quarterly Transaction Trends

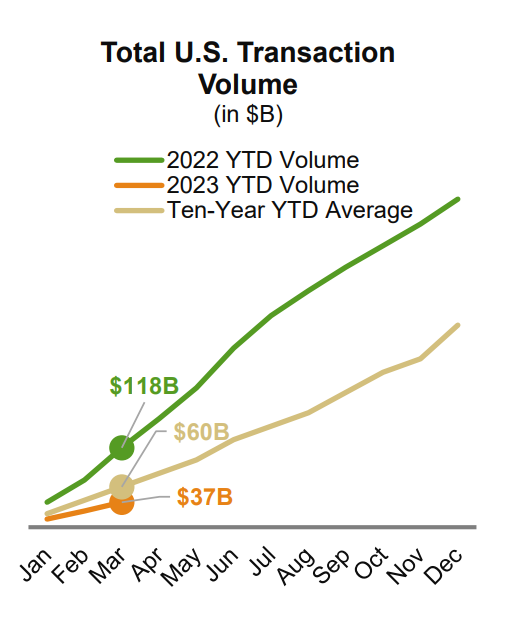

Green Street has published a new report stating that first-quarter sales volume dropped 70% year-over-year across all four of the core sectors: Office, Industrial, Apartments and Retail, as property values continue to erode.

U.S. Sales Comps data on transactions of $5 million and higher was utilized to produce the new report entitled, Property Insights: Quarterly Transaction Trends.

Additional takeaways from the Property Insights report include:

- REIT M&A, another barometer of transaction volume, is on-pace for an average year.

- Public-to-public M&A deals are more likely than privatizations given the availability and cost of debt financing.

- The debt markets remain challenged as lending standards have tightened over the past year.

- Quarterly net new commercial real estate loan growth by banks has been shrinking in '23 and recently turned negative.

- CMBS issuance in 1Q23 declined 65% year-over year, but some recent deals “provide hope” for an increase in 2H23.