Property Insights: Roller Coaster

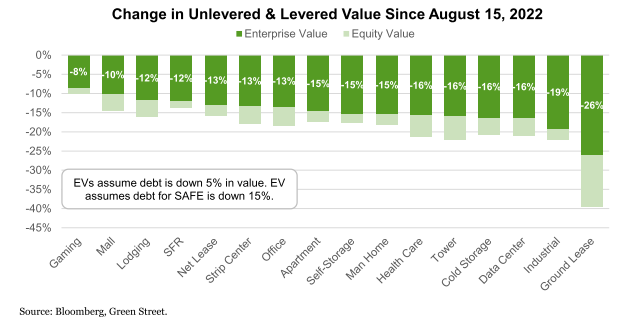

Given heightened uncertainty and the rise in rates vs. a couple of months ago, real estate values are likely headed lower in coming months absent a swift return to lower nominal and real rates. Green Street’s Commercial Property Price Index (CPPI) has declined 6% vs. peak values earlier this year, and our proprietary valuation of commercial real estate relative to corporate bonds provides a useful signal that suggests further declines from current pricing. Similarly, the current public market signal is also negative at a ~15% GAV discount. The recent REIT downdraft has quickly set share prices closer to where property values may ultimately land, but uncertainty is high. Green Street sector specialists will likely adjust values downward for many property types. Average declines in the ~5% range seem likely as a first step, or perhaps in the 25-50 bps range on cap rates.