Is Coronavirus the Retail Armageddon?

Long before the novel coronavirus struck, retail real estate was under pressure from retailer bankruptcies and store closures. The ecommerce boom has been undermining brick-and-mortar sales as consumers shift more of their shopping online from shopping centers. Covid-19 has made things worse for retailers by virtually eliminating international tourism and triggering compulsory quarantines that keep consumers at home and stores closed, except for those selling essentials. Will a prolonged fallout result in significantly lower rent payments in 2020 and wounded retailers for years to come?

There is a saying that history repeats itself, but there are key differences between the Covid-19 recession and the Great Financial Crisis a dozen years ago. The 2008 crisis was a credit crunch and not a government-imposed socially distanced chokehold. The demand-led 2020 recession puts property companies in a weaker position than 2008, likely resulting in permanently lost cash flows from many tenants during the business closure period and prospectively a greater chance of bankruptcies, despite government support.

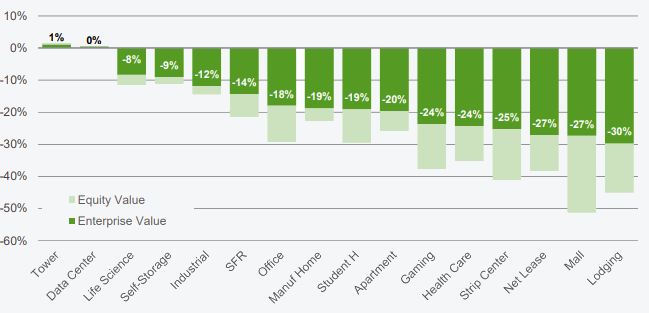

Fears over Covid-19 caused listed property values to begin dropping in late February, and since then the share price of retail real estate owners have declined by over 44% in the United States and 43% in Europe. It is still unclear by how much property values will decline in the private market, but the public market suggests sizable declines are upon us.

Change in U.S. Unlevered and Levered Values Since Feb 21

Some Tenants are Riskier than Others

Indefinite forced closures for stores selling non-essential goods have put most retailers in a uniquely unfavorable position. Tenants with low profit margins and minimal cash reserves will have an especially hard time navigating through the coronavirus storm. We will witness accelerated bankruptcies from some tenants and rent relief granted to many others. That said, different retail property types face individual risks.

U.S. strip center REITs generate about 30% of their rent from restaurants, small businesses, and tenants on Green Street’s bankruptcy watchlist. While the sector benefits from grocery anchors, this group of tenants is disproportionately affected by Covid-19 closures. Property companies are being barraged with demands for rent relief and, in some cases, notices that rent won’t be paid in the second quarter. Many landlords have already offered undisclosed terms for rent deferrals or rent relief on a case-by-case basis. Cash net operating income (NOI) declines for U.S. retail REITs could be unparalleled in 2Q20, potentially surpassing -30%.

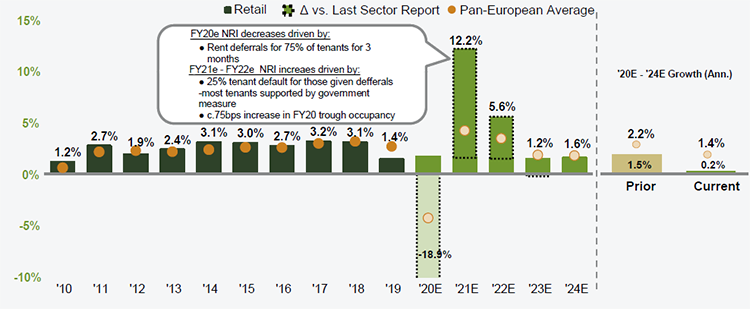

Pan-European retail is being equally impacted. On the public side, like-for-like net rental income (NRI) growth peaked in 2017 and has long been forecast to be on a downward trajectory since. Covid-19 has accelerated this decline substantially. Early read on UK retail 2Q20 rent payments suggests that about a third of the rent has been paid so far. The situation on the continent is not publicly disclosed, but probably roughly comparable. Some of the rent that hasn’t yet been paid will be deferred into the future, but undoubtedly a lot of it will also be forgiven. As a result, listed property companies cash flows should be down meaningfully in 2020, but rebound somewhat next year. For more on European retail woes, see Retail Sector Update: Sisyphean Struggle.

Like-for-Like European PropCo NRI Growth

The Financial Burden: Shared Pain

Even tenants with stronger credit and the ability to pay rent are asking for concessions under the premise that the burden of lost sales should be shared between tenant and landlord. That should lead to significant debate and litigation – in both the United States and Europe – regarding whether Covid-19 falls under the "force majeure" clause. While such clauses are occasionally included in contracts, pandemics may not be listed as a trigger. As a result, it is difficult to handicap whether or how much such a provision will be used over time. Even so, just the threat could make landlords more willing to work with tenants on lease modifications. Pragmatism might eventually reign as a partnership in pain is established between landlords and tenants as they decide how, or if, 2Q20 rent should be paid.

Financial relief for tenants could also come in the form of government aid. In the United States, the $2 trillion CARES Act was designed to help individuals and small businesses greatly impacted by the pandemic. Within the strained world of retail, this is relatively positive news for strip centers. Landlords catering to small tenants in certain other sectors are also likely beneficiaries. In addition, tenants and landlords who don’t benefit directly from the CARES Act are eligible for payroll tax credits. A technical correction to the qualified improvement property depreciation drafting error from the 2017 tax reform law also allows interior improvements of non-residential property to be expensed. This change will generate $15 billion in immediate tax refunds for restaurants and retailers, according to the National Retail Federation. For more insights on how the CARES Act will benefit commercial real estate, read Property Insights: Everybody CARES.

Across Europe, economic assistance programs come in a variety of sizes and forms, but they revolve around relief and direct payments to workers, loan guarantees and backstops for businesses - which often account for the bulk of the aid provided - and tax relief and deferrals. Each program will be adjusted as the broader economic fallout materializes, but some countries (Nordics, Switzerland, Germany) are certainly in a far superior fiscal position to provide robust programs in difficult times. In France, Italy and Spain, however, leaders face higher pre-existing national debt, so offering economic relief programs will put their debt-to-GDP ratios in an even less enviable position.

Relative Winners and Losers

Despite the apparent constant stream of bad news, there are always relative winners and losers in the sector. This provides an opportunity to make investment decisions based on property-type, tenant concentration and the financial situation of each owner. In the United States, strip center REITs are generally in a better financial position than mall REITs. In Europe, continental retail property companies are preferred to their UK compatriots. In both instances, however, it is the company-specific balance sheet, including the ability to fund near-term liquidity needs, that will ultimately decide. Companies with frail balance sheets and high exposure to weak tenants are going to find themselves in a difficult position in the coming months. Gain access to Green Street’s U.S. and European sector and company recommendations by reaching out to our team at inquiry@greenstreetadvsiors.com.

Related Resources:

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Video

Market Opportunities Amidst Revised Outlooks

Year in Review

Top U.S. News Highlights from 2023

Macro Topics