How Inflation Is Impacting Commercial Real Estate: By the Numbers

A confluence of factors, including skyrocketing energy prices, dwindling consumer confidence, volatile debt markets, and negative feedback from plunging asset prices, has resulted in a slowing U.S. economy. Unlike the pandemic era when some property sectors – such as industrial, self-storage and single-family rentals (SFR) – flourished, rapidly rising inflation and real rates have taken a toll on the commercial real estate market.

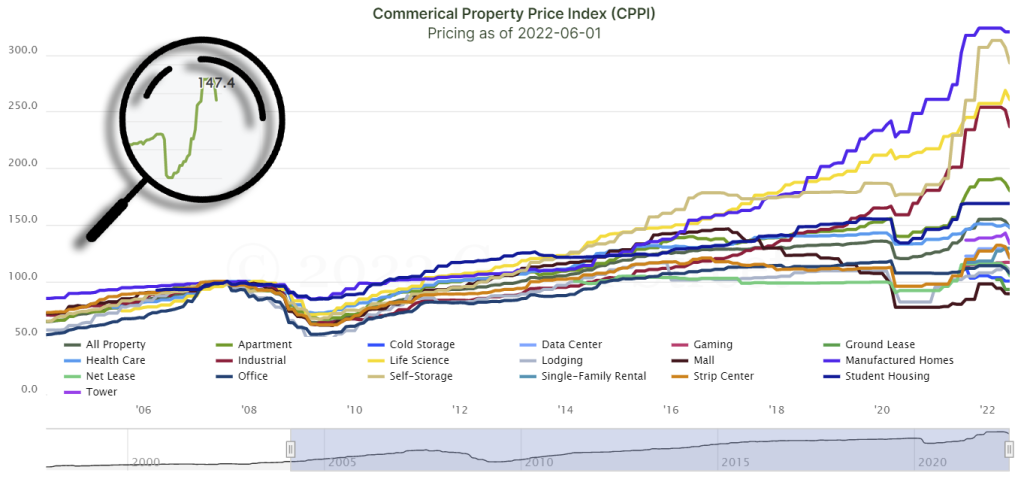

How will inflation impact core property sectors? As of midyear 2022, Green Street lowered its estimates for near-term rents, occupancy rates and NOI growth, and also reported reduced transaction volumes and ongoing interest-rate volatility. According to Green Street’s June Commercial Property Price Index, property values have dropped nearly 5%, and not one single sector seems to be immune to the re-pricing that has occurred.

Sign up to get Green Street’s CPPI delivered to your inbox monthly

In spite of inflationary fears, Green Street only anticipates a “mild recession,” which will manifest itself in moderating 4Q 2022 U.S. employment growth that is expected to improve modestly as early as next year. During economic sifts, rental and occupancy rates, as well as investment sales transaction volume, are almost immediately impacted, according to Michael Knott, Green Street’s U.S. head of REIT Research. However, some property sectors will feel inflation’s impact more than others. Namely, he says, the (non-core) lodging sector faces the highest potential risk since it’s tied so closely to the economy.

Below, Green Street’s Data & Analytics team examines inflation’s impact on all four core property sectors: Office, industrial, apartments and retail.

Inflation’s Impact on the Office, Industrial Sectors

The office sector still hasn’t recovered from the damage caused by the Coronavirus pandemic. Green Street’s recently updated web platform provides the evidence: Office Market-RevPAF growth – Green Street’s proprietary measure of rent and occupancy growth – was -8.4% in 2020 and -6.2% in 2021 due to the fallout from extensive work-from-home (WFH) policies among many office-using employers in the U.S. Green Street anticipates another 3.5% drop in Market-RevPAF in 2022 before finally achieving modest positive growth in 2023 and beyond.

According to Green Street’s CPPI, U.S. office property values dipped by about 4% in the month of June 2022 and are down 9% relative to pre-Covid levels. In May 2022, transaction volume of office buildings priced at $25 million or above totaled about $3 billion, compared to May 2021 when investors closed more than double that amount: Approximately $8 billion.

During Covid and in the months before the outbreak, the industrial property sector was a favorite among both public and private market investors. A slowdown in e-commerce activity at U.S. warehouses in the first few months of 2022 has softened investor demand, a trend so noteworthy that Green Street hosted a mid-July Industrial webinar to further explore its impact. Full-year 2022 expected Market-RevPAF growth for industrial assets currently stands at 18%, roughly in line with 2021’s record pace. In 2023 and beyond, Green Street predicts a deceleration, with Market-RevPAF growth slowing to about 3% per year through 2026.

Industrial property values dropped by about 6% in June 2022 but are still up 18% over the past year and are 42% above pre-Covid levels. Total transaction volume for industrial properties priced above $25 million followed a similar pattern as the office sector: In May 2022, transaction volume for institutional-quality industrial assets dropped to approximately $7 billion, compared to $15 billion the previous May, a 50+% decline.

Inflation’s Impact on the Apartment Sector

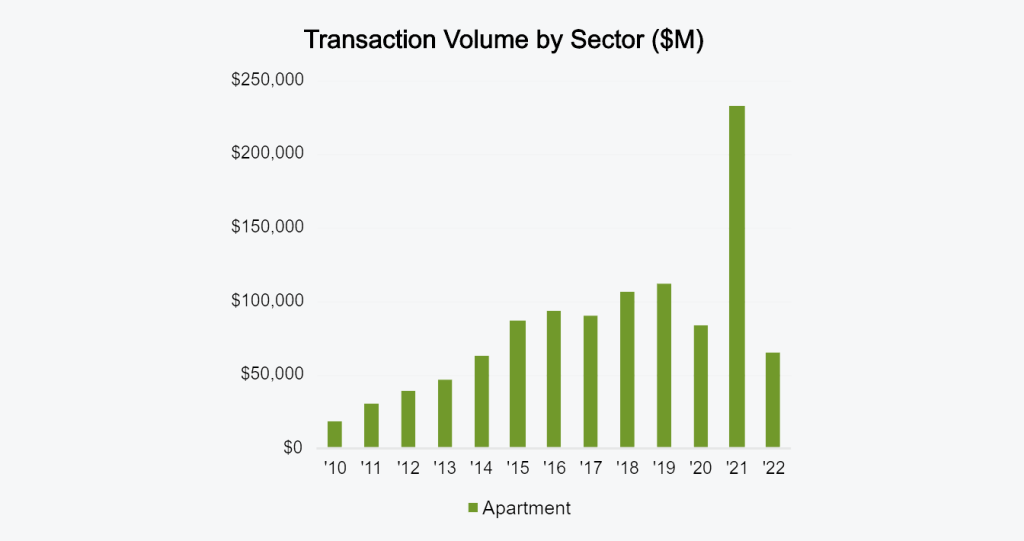

Historically viewed as a safe investment during economic downturns, Green Street’s Market-RevPAF growth outlook for the apartment sector remains healthy. Based on the firm’s most recent analysis, 2022 is slated to be the strongest one for apartments, as Market-RevPAF growth is forecast to increase 10% by year end. It is expected to remain positive at 3% in 2023, and 2.3% in 2024.

Apartment values declined about 4% in the last month, but are still up 15% over the past year and 16% relative to pre-Covid levels, according to Green Street’s CPPI. In spite of the pandemic, apartment transactions priced at $25 million and above totaled $10 billion in May 2021, compared to only $9 billion in May 2022.

Inflation’s Impact on the Retail (Strip Center) Sector

The performance of the strip center property sector over the past two months threw a curveball at Green Street analysts, according to Knott. “The distinct change in momentum over a short period of time was quite surprising,” he said during a recent company-wide call.

After suffering during the pandemic, the strip center sector staged a strong comeback in the second half of 2021 and first few months of 2022. In 2020, rent and occupancy growth was negative-6.6%. A year later, strip center Market-RevPAF growth elevated into positive territory at 0.7%. By year-end 2022, Market-RevPAF growth is anticipated to accelerate to 3.1% and then moderate to the 1% to 2% growth range through 2026.

Unlike other major property sectors, transaction volume of deals priced above $25 million increased six-fold from May 2021 to May 2022. In May 2021, strip center deal volume stood at $805 million, rising to $4.8 billion this May. Values of strip retail properties, however, declined 7% over the last few months. Nonetheless, values have increased 15% over the past 12 months and are up 7% relative to pre-Covid levels.

Access Real-Time CRE Intelligence

As inflationary pressures mount across the globe, Green Street will remain responsive to rapidly changing commercial real estate market conditions, including supply-and-demand fundamentals, pricing and real-time transaction activity. The aforementioned forecasts could be cut even further, notes Knott. “When properties start to trade again in earnest, we will get a better sense of when market conditions will start to bounce back.”

In the meantime, existing Green Street clients can check for new Sector Reports, Property Insights and other research to remain up to date on the latest conditions impacting the office, industrial, apartment and retail property sectors. The reports are located on the firm’s dynamically interconnected web platform that provides a 360-degree view of commercial real estate. For the latest Market-RevPAF growth and transaction data by property sector, clients can view Green Street’s Standardized Downloads within Data & Analytics.

If you would like to access Green Street’s valuable research, data and analytics to optimize your investment decisions, connect with an account associate for a customized dive into our web platform.

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Sector Outlooks

Diving Into The Golden Age of Data Centers With New Green Street Outlook

Reports Highlights

Month in Review: Five Must-Read U.S. Research Reports

Video