Betting Against the Spread: Insights from Green Street University

During the final session of Green Street University 2021 held Jan. 13, Managing Director of Real Estate Analytics Joi Mar asked the online audience of real estate professionals where they thought property prices would be headed this year. Nearly three-quarters of the poll respondents said flat, or down. Just 28% predicted prices would rise more than 5%.

But Green Street’s Real Estate Securities Monthly calculates that both REITs and private real estate are dramatically undervalued compared to equities and bonds. Versus stocks, we calculate that other than briefly during the Global Financial Crisis, REITs are the cheapest they’ve been in 16 years.

Contact Us for analysis on this shift in signals and insight from our latest Heard on the Beach: Deja Vu.

Many sectors that have been hammered by the Covid-19 pandemic appear to be relative bargains. Green Street’s Real Estate Securities Monthly forecasts that Apartment, Net Lease and Health Care REITs will post above-average returns after suffering double-digit declines since the start of the pandemic.

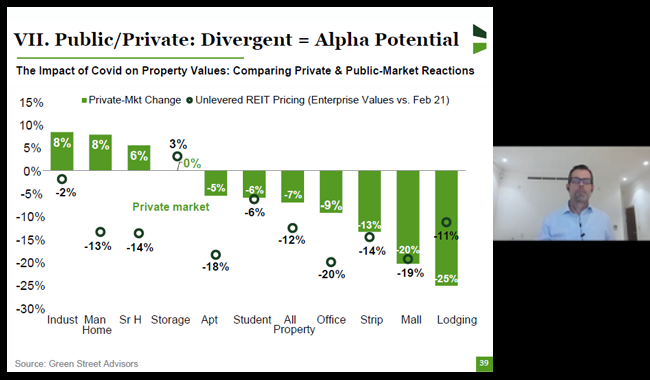

In addition to explaining how we value real estate, Green Street University provided actionable intelligence on potential investment strategies capitalizing on valuation spreads between the public and private markets. The chart below, comparing the impact of Covid-19 on public and private commercial property prices, shows a huge valuation gap in some sectors.

“Clearly the public market sees this more negatively than the private market does. Maybe the public market has a point because it tends to be more forward-looking, but the public market might also have gone too far in its negative view,” explained Cedrik Lachance, Green Street’s Director of Global REIT Research.

One of Green Street’s unique strengths that creates clear profit opportunities for customers is our time-tested expertise in identifying valuation gaps for investors who operate in both public and private commercial real estate.

“The existence of dual real estate markets that often head in different directions provides investors an opportunity that is about as close to a free lunch as can be found anywhere in the investment arena. The fact that so many investors have failed to take note of the opportunity means that it is destined to remain lucrative for those who do,” Heard on the Beach: Benchmarks for a Modern Age.

In addition to macro and sector insights, one of the Green Street University sessions showed clients how to approach market and asset-level analysis using Atlas, Green Street’s interactive mapping and analytics platform offering a seamless way to access proprietary data on operating fundamentals and property-specific intelligence. An exciting new product enhancement was the 50,000 recently added verified transactions going back 15 years, totaling more than $3 trillion in deal value. Green Street’s verified transactions are a unique, proprietary offering that is unmatched in the marketplace. Verified transactions are not based on often unreliable public record data, but rather come from a high-quality, reliable source and a Green Street analyst has also verified that details are correct. Schedule a Demo of Atlas

One component of the Atlas tool is its ability to grade top 50 markets, more than 700 submarkets and 6,000 zip codes. Play this brief video to hear Claire Arora, Green Street’s Senior Customer Success Manager, describe how that works:

Green Street has been keenly focused on the increased importance of non-core real estate sectors for several years. In 2018 we expanded our Commercial Property Price Index to include 15 sectors, which provides a significant advantage over other widely used benchmarks by tracking the real estate tied to tomorrow’s economy. “It’s as if modern-day mutual fund managers were benchmarked to an S&P 500 dominated by GE, GM, IBM, Walmart, and Exxon, with no weighting accorded to Amazon, Apple, Alphabet, or Facebook,” we wrote at the time.

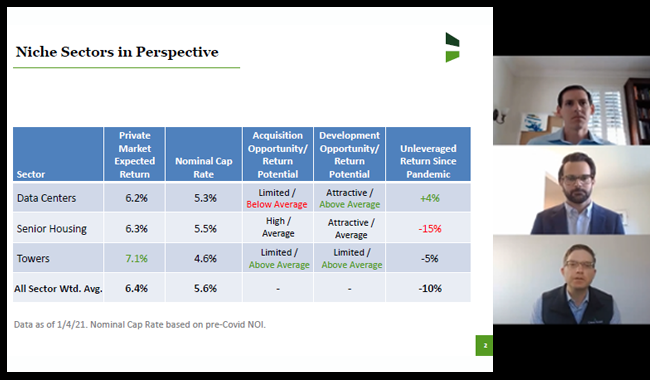

During Green Street University, attendees learned we are devoting even more resources to coverage of niche commercial real estate sectors, including Towers, Data Centers and Senior Housing.

“When we look at these three property types together, some interesting things come out,” said Michael Knott, Managing Director, Head of U.S. REIT Research at Green Street. “In the public market since the pandemic, you can see that Data Centers on an unlevered basis have performed really well. They’ve actually increased in value. Towers has been a little bit less strong and Senior Housing has obviously been challenged by Covid.”

Green Street University concluded with Cedrik Lachance answering a client’s question about how to use Green Street’s model REIT portfolio to construct a winning mix of private property investments. “It’s using the public market signals to get a sense of what should happen to private values and therefore increasing your bets or investments in those private sectors where the public market has been most bullish,” Lachance said.

And for now, the ability to maximize value by investing in both public and private commercial real estate seem about as good as ever.

Related Resources:

- View: Commercial Property Price Index

- Schedule a Demo: Atlas/Enhanced Transaction Database

- Learn More: Green Street’s Methodology

- Download Report: Featured Insight: Heard on the Beach: That’s Where the Money Is

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

ESG and Climate Change

Energy In The Economy: Energy Is The Economy

Year in Review

Annual Commercial Real Estate Year in Review

Video